refund for unemployment taxes 2021

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. If you received unemployment benefits last year you may be eligible for a refund from the IRS.

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

. IR-2021-71 March 31 2021. Once those corrections are finished the IRS said it will adjust returns for those who are. Floridas 2021 SUI tax rates also referred to as reemployment tax increased to range from 029 to 54 up from 01 to 54 for 2020.

Account Services or Guest Services. There are two options to access your account information. The first 10200 in benefit income is free of federal income tax per legislation.

The IRS reported that another 15 million taxpayers will. The amount of the refund will vary per person depending on overall. The deadline for filing your ANCHOR benefit application is December 30 2022.

TAS Tax Tip. We will begin paying ANCHOR benefits in the late Spring of. More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. You may check the status of your refund using self-service. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Attention ANCHOR Applicants. The unemployment tax refund is only for those filing individually. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their.

WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence.

If you use Account Services. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. The SUI new employer rate remains at 27 for.

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Unemployment 10 200 Tax Break Some States Require Amended Returns

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

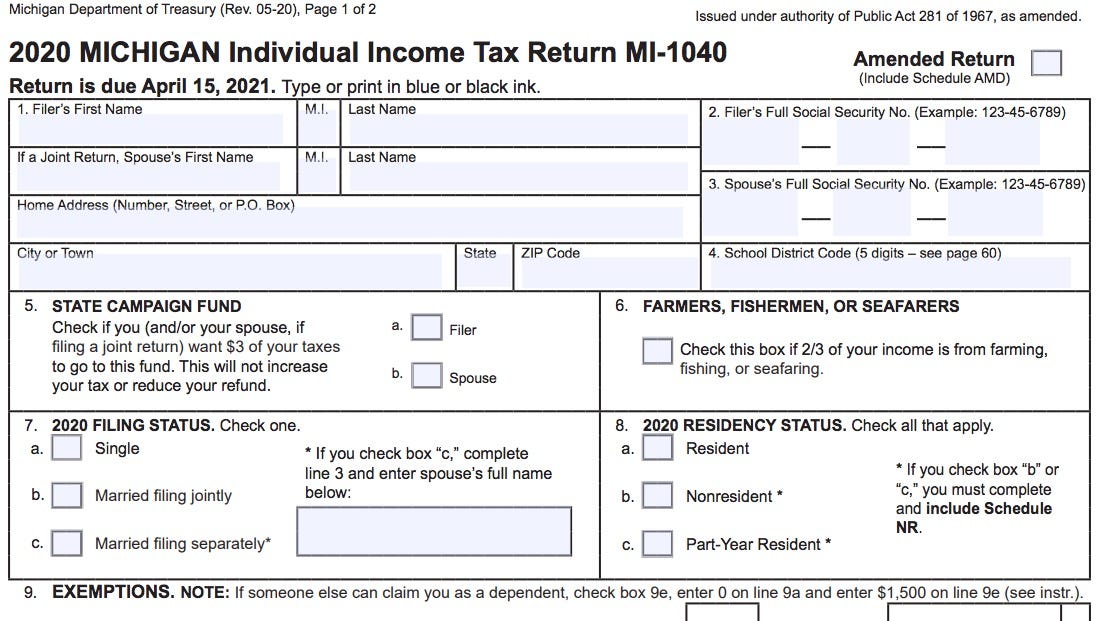

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Irs Sends Out 4 6 Million Refunds To Taxpayers For Overpayments Wfmynews2 Com

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Taxpayers May Receive A Refund For Taxes Paid On 2020 Unemployment Compensation Tax Pro Center Intuit

Irsnews On Twitter Irs To Recalculate Taxes On Unemployment Benefits Money Will Be Automatically Refunded This Spring And Summer To People Who Filed Their 2020 Tax Return Before The Recent Changes Made

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

1099 G Unemployment Compensation 1099g

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Taxes 2021 What To Expect For The 2021 Tax Season Tax Foundation

Unemployment 10 200 Tax Break Some States Require Amended Returns